Supercharge your defense operations with NDL solutions. Dive into a partnership that expands your team's cognitive reach. Ready to amplify your project's impact?

Trump’s Rare Earth Ultimatum: What the China Warning Means for U.S. Security and Supply Chains

Introduction

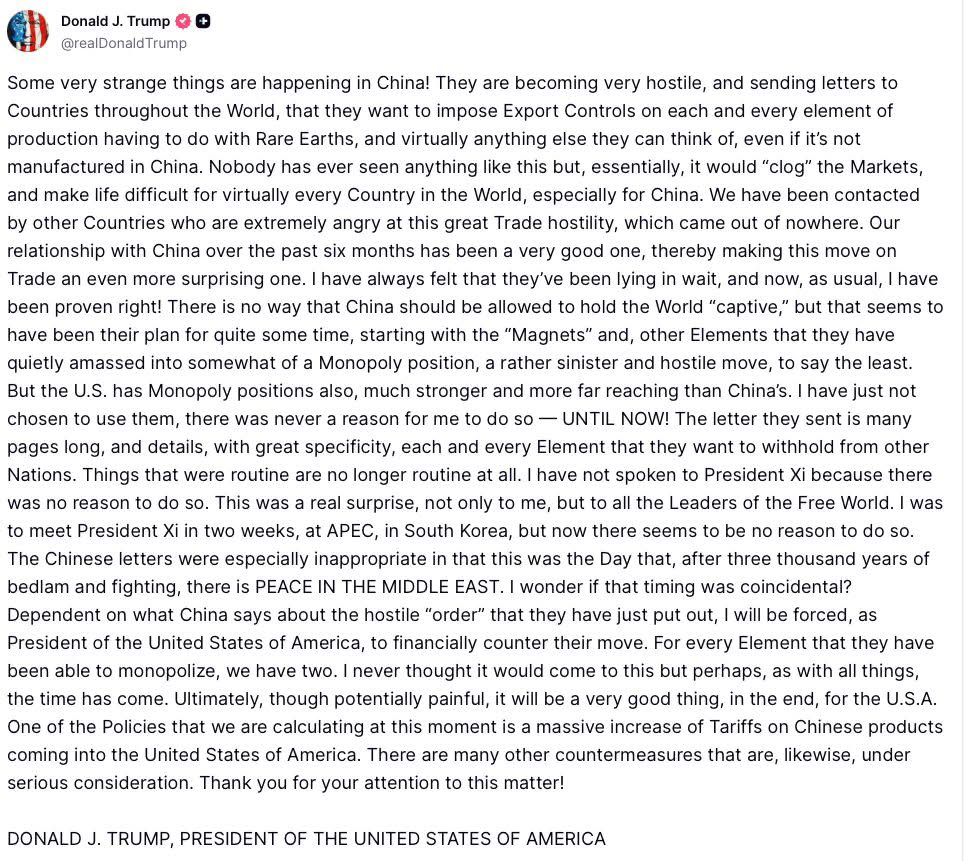

A public declaration threatening new tariffs on Chinese goods and countermeasures to Beijing’s export controls would signal a major turning point in the global competition for strategic resources.

Such a statement would mark the formal beginning of what analysts could call a critical-materials confrontation—a contest over the minerals and refined elements that power the modern world.

Rare earth elements (REEs) and associated critical minerals form the invisible architecture of twenty-first-century technology. They are used in the magnets that steer precision-guided munitions, the sensors in fighter jets, the batteries in electric vehicles, and the permanent magnets in wind turbines and satellites. A disruption in this supply chain would not simply raise prices; it could paralyze sectors of defense manufacturing, energy production, and advanced electronics.

1. What Rare Earths Are and Why They Matter

Rare earths are a group of seventeen metallic elements, including neodymium, dysprosium, and terbium, prized for their magnetic and luminescent properties. Although not truly “rare,” they are rarely found in concentrations high enough for easy extraction, and refining them requires complex, environmentally sensitive processes.

Applications include:

- Defense systems: guidance systems, radar, jet engines, sonar, and satellite components.

- Energy storage: batteries, renewable power generation, and grid stabilization.

- Electronics: smartphones, computing hardware, and advanced sensors.

Control over REEs translates into leverage over global manufacturing chains and national security infrastructure.

2. The Current Balance of Power

For decades, China has dominated the mining, separation, and refining stages of rare-earth production. Estimates place its share of global refining capacity above 80 percent. This concentration is not accidental. Through long-term subsidies, export-quota management, and acquisition of foreign deposits, Beijing turned rare-earth processing into a strategic industry.

Other nations, including the United States, Australia, and Canada, possess sizable deposits, but their refining capacity remains limited. Environmental restrictions, inconsistent market pricing, and the loss of domestic technical expertise contributed to dependence on Chinese refineries.

When export controls are tightened or quotas reduced, prices spike worldwide. For the United States, which relies on rare earths for every advanced weapon system, this dependence introduces a serious vulnerability.

3. The Defense Connection

Each branch of the U.S. military relies on materials containing rare earths.

- Aerospace and missiles: Neodymium-iron-boron magnets guide control surfaces and seeker heads.

- Satellites and communications: Europium and yttrium enable specialized coatings and sensors.

- Energy and logistics: Lanthanum and cerium are used in fuel-cell catalysts and hybrid-engine batteries.

A single F-35 fighter jet is estimated to contain more than 400 kilograms of rare-earth materials distributed across its propulsion, avionics, and communication subsystems. A sustained shortage would slow aircraft production, delay satellite launches, and weaken readiness across multiple domains.

4. U.S. Countermeasures and Possible Policy Responses

If the United States were to respond decisively to a Chinese export clampdown, the options would fall into several categories.

A. Tariff and Trade Policy

A massive tariff increase on Chinese products containing rare-earth inputs would be an immediate, though limited, measure. It could protect domestic producers and raise funds for stockpiling but would not solve the structural dependency on Chinese refining.

B. Domestic Production and Processing

Reinvigorating domestic mining and refining capacity is the long-term solution. Projects in California’s Mountain Pass mine and new facilities in Texas and Wyoming could expand output if supported by guaranteed federal procurement contracts and streamlined permitting.

The FY2027 R&D Priorities memorandum identifies energy and natural resources as a key investment area, calling for “research and innovation in critical-mineral extraction, separation, and recycling technologies.” Aligning these priorities with defense procurement could accelerate the creation of a full domestic supply chain.

C. Allied Sourcing and Cooperative Agreements

Allied countries such as Australia and Canada already produce and process rare earths. Formalized agreements under frameworks like the Quadrilateral Security Dialogue could pool resources and share refining technology, spreading risk across trusted partners. Japan’s investments in Lynas Rare Earths Ltd. provide a successful model for diversification through allied cooperation.

D. AI-Driven Material Substitution and Recycling

Artificial intelligence and advanced modeling can identify substitute materials that replicate rare-earth performance at lower cost or with more abundant elements. Machine learning also enhances recycling efficiency by analyzing scrap composition and predicting optimal separation processes.

The FY2027 R&D memo’s first priority, critical and emerging technologies, explicitly calls for AI-enabled discovery and advanced manufacturing. Integrating AI into materials science may reduce strategic vulnerability more effectively than tariffs or stockpiles.

5. Strategic Risks and Global Repercussions

A new rare-earth confrontation would reverberate through global markets.

- Economic Impact: Price spikes would affect not only defense industries but also renewable energy and automotive sectors.

- Allied Response: European and Asian partners reliant on Chinese inputs might be forced to choose sides or accelerate diversification.

- Environmental Pressure: Expanding mining and refining in new regions raises sustainability concerns that must be addressed through better waste management and cleaner extraction technologies.

Ultimately, both nations risk destabilizing the very markets that sustain their advanced industries. For the United States, careful calibration is necessary to ensure economic strength is not sacrificed for short-term leverage.

6. Integrating FY2027 R&D Priorities

The FY2027 Administration R&D memo places critical minerals and energy resilience at the heart of its strategy. It identifies goals to:

- Develop cleaner and more efficient extraction and processing methods.

- Strengthen domestic supply chains for defense-relevant materials.

- Foster public-private partnerships to integrate commercial expertise.

- Encourage the use of AI and quantum computing for supply-chain optimization.

Aligning rare-earth policy with these priorities transforms short-term trade retaliation into a long-term resilience program. By channeling tariff revenues or defense appropriations into R&D and infrastructure, the United States can create self-sustaining supply networks that outlast any single diplomatic crisis.

7. Recommendations

- Establish a National Critical-Minerals Reserve similar to the Strategic Petroleum Reserve to buffer against supply shocks.

- Expand domestic refining capacity through targeted tax credits and defense procurement guarantees.

- Integrate critical-materials R&D into the Department of Energy’s national laboratory agenda.

- Promote allied investment frameworks that secure mutual access to refined rare earths.

- Fund AI-driven substitution and recycling research consistent with FY2027 R&D goals.

Conclusion

A rare-earth confrontation between the United States and China would expose the fragility of the modern economy and the interdependence of energy, technology, and defense. Yet it could also catalyze long-overdue investment in domestic capacity and allied cooperation.

The lesson from any potential “rare-earth ultimatum” is clear: strategic autonomy requires foresight, coordination, and sustained innovation. The FY2027 R&D framework provides the roadmap. What remains is the resolve to follow it.

Downloads

White Paper: Trump’s Rare Earth Ultimatum: What the China Warning Means for U.S. Security and Supply Chains (Download)

Podcast

Citation

President Trump Truth Social. “Trump’s Rare Earth Ultimatum: What the China Warning Means for U.S. Security and Supply Chains.” 10/10/25 11:35 PM, 2025. https://truthsocial.com/@realD...