Supercharge your defense operations with NDL solutions. Dive into a partnership that expands your team's cognitive reach. Ready to amplify your project's impact?

Strategic Orbit: How Commercial Satellites Are Redefining Military Intelligence in the Ukraine-Russia War and Beyond

Strategic Orbit: How Commercial Satellites Are Redefining Military Intelligence in the Ukraine-Russia War and Beyond

Executive Summary

Between 2022 and 2025, the Russo-Ukrainian War revealed a tectonic shift in modern intelligence and warfighting: commercial satellite services, Starlink internet, Planet Labs, ICEYE, Maxar imagery, and emerging EU systems, transitioned from civil infrastructure into active military platforms. This white paper examines how these assets became strategic force multipliers, fueling real-time battlefield awareness, communications resilience, and command and control.

In Ukraine, over 50,000 Starlink and Starshield terminals, funded and contracted by the U.S. Department of Defense, sustained battlefield communications and drone operations across contested regions. Private satellite imagery from Planet Labs, Maxar, ICEYE, Capella Space, and HawkEye 360 provided high-frequency, all-weather overhead intelligence to Ukrainian forces and allied analysts. A May 2025 RAND report highlights the transition from state-only intelligence, surveillance, and reconnaissance (ISR) to hybrid networks, emphasizing decentralization, redundancy, and commercial integration.

This integration created strategic vulnerabilities. In March 2025, the U.S. suspended Ukrainian access to the Global Enhanced GEOINT Delivery (GEGD) platform, cutting off critical shared imagery and demonstrating the risks of dependency on U.S.-controlled archives. In 2022, Elon Musk reportedly ordered localized Starlink shutdowns in Kherson, disrupting Ukrainian operations during a counteroffensive, revealing the risk of private decision-making overriding military necessity. Meanwhile, Russia and China increasingly used GPS and communications jamming and developed anti-satellite capabilities, threatening the resilience of civilian constellations now embedded in warfare.

Looking forward, the European Union's IRIS2 and Britain’s ISTARI/Tyche satellite programs aim to reduce dependency on U.S.-led constellations by 2027 to 2030. The U.S. Space Force’s Protected Tactical SATCOM (PTS-G) initiative is leveraging commercial satellite designs from Viasat, Astranis, Boeing, Intelsat, and Northrop Grumman to create hardened, anti-jam communications. Analysts warn that future wars will feature AI-powered anomaly detection, GEOINT fusion, and automated battlefield decision support, a new domain of predictive space intelligence.

Commercial space services are no longer passive infrastructure. They are active theaters of conflict, competition, and cooperation. Governments must prepare for this future with regulatory clarity, strategic investment, and resilient architectures.

Introduction: The Commercial Space Turn in Modern Conflict

Where once nations relied solely on state-run satellite systems, modern warfare now runs through private constellations and subscription-based imagery services. The proliferation of commercial satellite platforms has blurred the lines between civil and military infrastructure. Ukraine’s reliance on Starlink for command continuity, NATO’s integration of Planet Labs and Maxar imagery, and Russia’s targeting of private systems illustrate this seismic shift.

This transformation is not purely technological, it is geopolitical, legal, and doctrinal. Ukraine relied on commercial satellites to overcome ISR gaps. NATO leveraged them for deniable support. Russia and China were forced to weigh retaliation options against privately owned systems supporting enemy combatants. Elon Musk’s reported refusal to activate Starlink in Crimea during a 2022 counteroffensive exemplified the vulnerabilities of this model. Simultaneously, high-revisit commercial imagery enabled civilian researchers to track troop movements and verify war crimes.

These technologies are powerful. They are also dangerous without structure. The challenge ahead lies in harnessing this capability while mitigating dependency, fragmentation, and legal ambiguity.

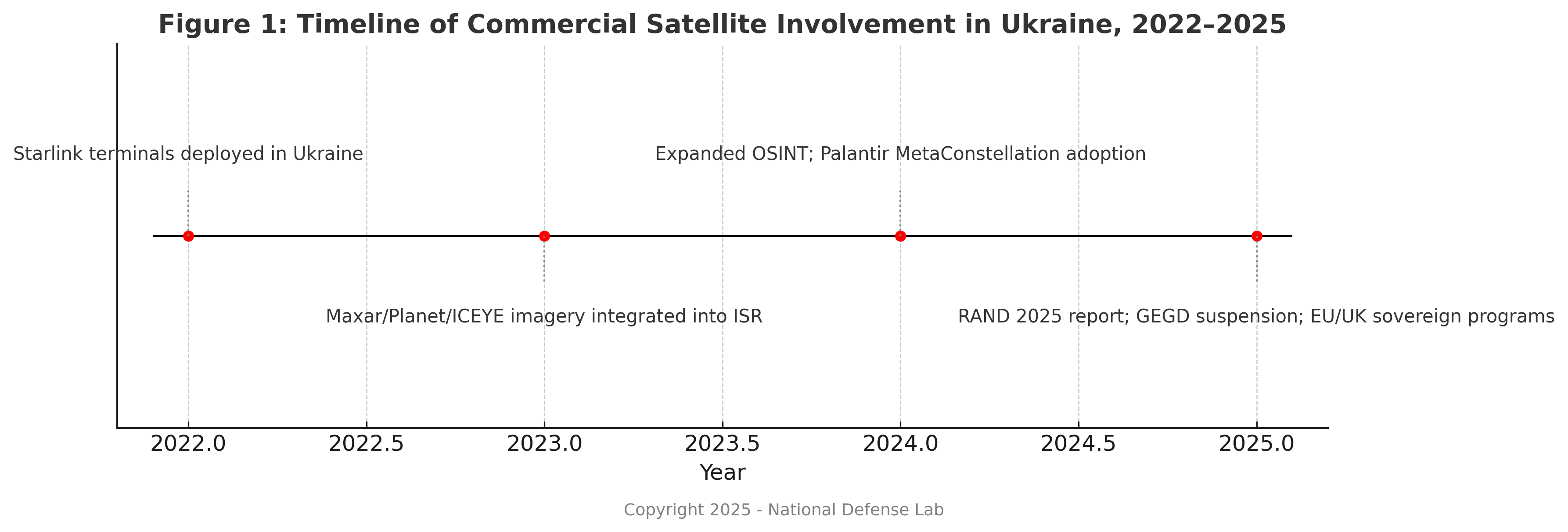

[Figure 1: Timeline of Commercial Satellite Involvement in Ukraine, 2022–2025]

Ukraine as a Proving Ground: Starlink, Maxar, and the Civil-Military Convergence

Starlink and Battlefield Internet

Over 50,000 Starlink terminals enabled encrypted communications, drone integration, and command continuity. When Russian attacks severed terrestrial infrastructure, Starlink kept Ukrainian units online. But in 2022, Elon Musk reportedly denied access over Crimea without government consultation. This politicized access to military infrastructure has become a point of international concern.^1^

Satellite Imagery Providers

Ukraine accessed synthetic aperture radar (SAR) and electro-optical (https://www.imsar.com/portfoli...) imagery from Maxar, Planet Labs, ICEYE, and others. SAR systems like ICEYE provided nighttime and all-weather capabilities. Planet’s CubeSats updated geospatial coverage daily. Maxar’s high-resolution imagery confirmed battlefield damage and troop positions.^2^

OSINT Analysts and the Public War

Civilian OSINT groups like National Defense Lab, Oryx, Bellingcat, and DeepStateMap used commercial imagery to track convoys, debunk propaganda, and pressure foreign governments. Satellite data is no longer a classified domain. It is now global, searchable, and public.

Intelligence Integration: From Multi-INT to Unified Decision-Making

ISR Platform Fusion

Ukraine demonstrated that combining SIGINT, GEOINT, HUMINT, and OSINT into real-time decision platforms could produce strategic results. Tools like GIS Arta and Palantir’s MetaConstellation fused battlefield data with satellite streams. Frontline troops could task satellite revisits, mark targets, and coordinate artillery in hours, not days.^3^

Role of AI

AI performed anomaly detection, terrain change analysis, and pattern recognition in overhead imagery. Natural language processing (NLP) systems translated intercepted Russian communications and flagged operational risk.^4^

International and NGO Coordination

The National Geospatial-Intelligence Agency (NGA) and European allies worked with commercial vendors to rapidly declassify imagery for public release and operational support, balancing transparency with security.

Strategic Risks: Reliance, Retaliation, and the Commercial Combatant Dilemma

The Musk Precedent

One billionaire’s hesitation disrupted a national operation. This is unacceptable in kinetic conflict. Department of Defense contracts now include language to prevent unilateral disruptions.^5^

Legal Status of Commercial Assets

Russia threatened retaliatory strikes against commercial satellites being used for military support. International law has yet to define what happens when commercial space systems act as auxiliaries.^6^

Infrastructure Risks

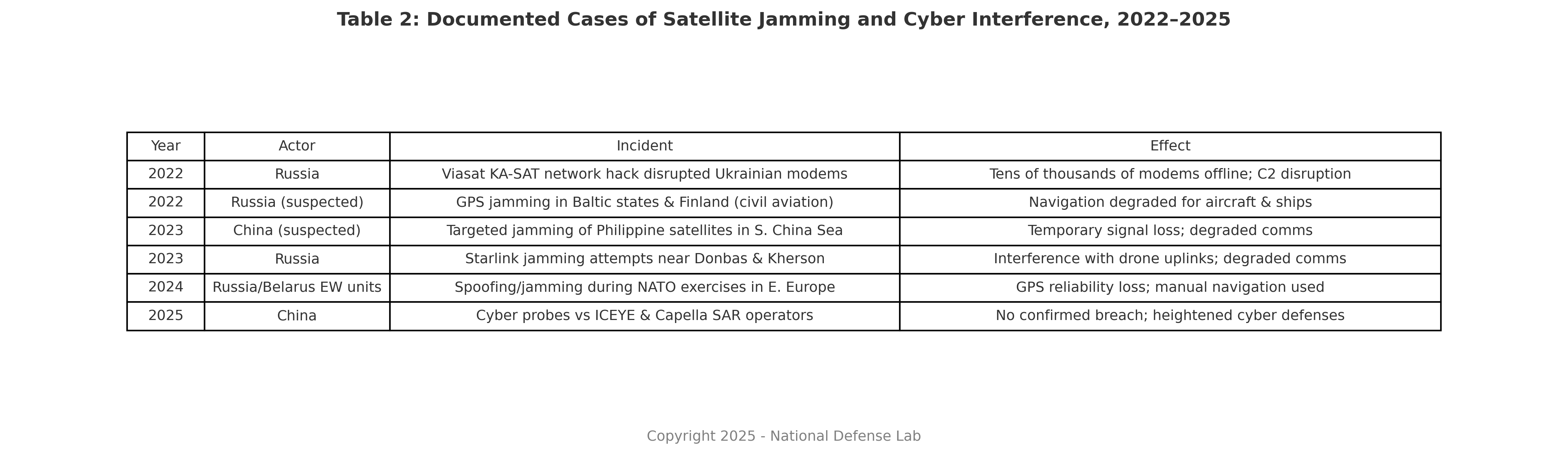

Commercial satellites are vulnerable to jamming, spoofing, and cyberattack.^7^

Strategic Dependency

SpaceX dominates broadband low-Earth orbit (LEO). Maxar and Planet dominate imagery. Without alternatives, strategic autonomy suffers. Diversification and regulation are now critical.

Building Resilience: Redundancy, Regulation, and the Rise of Sovereign Space

EU and UK Alternatives

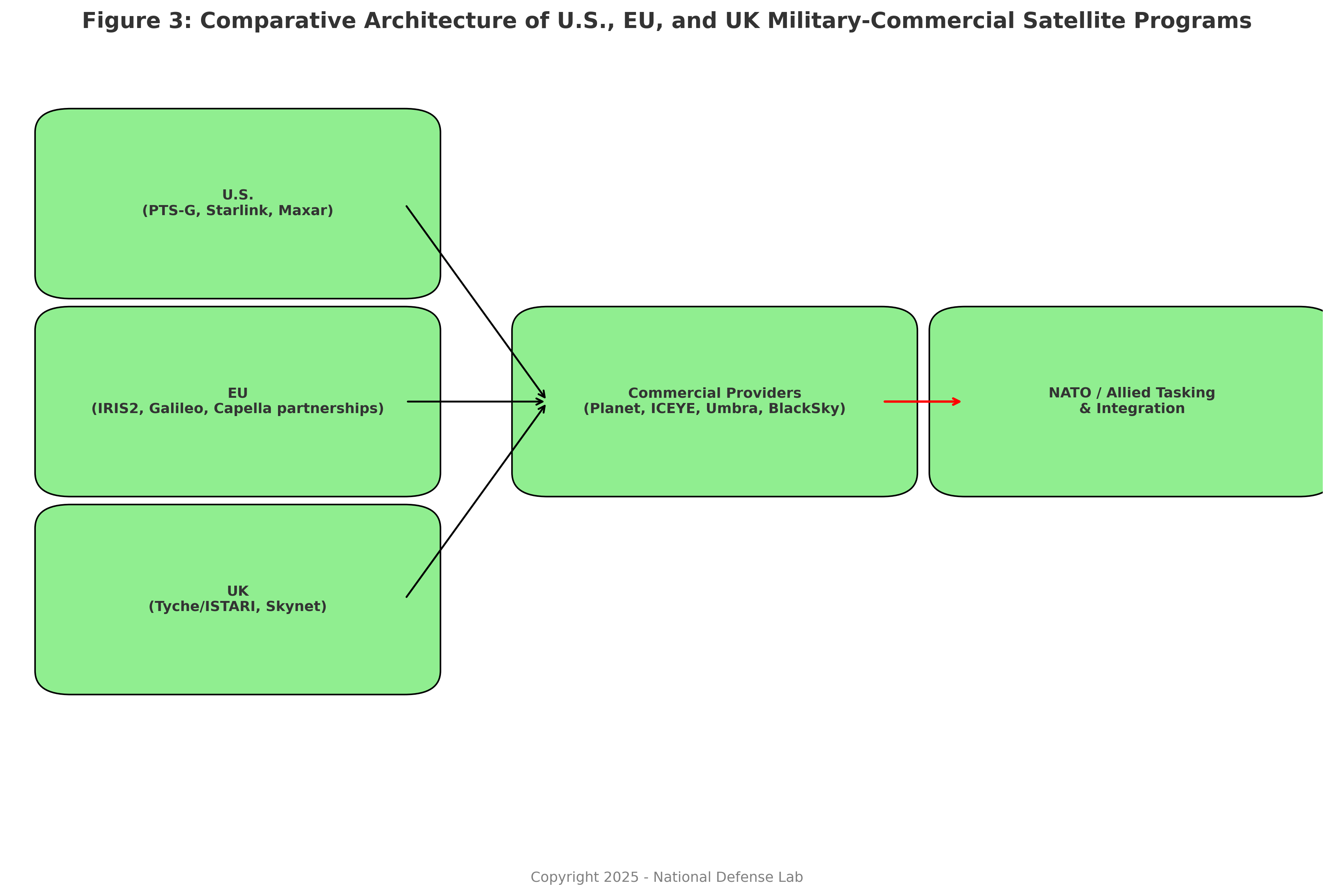

IRIS2 (EU) and Tyche (UK) will provide secure state-run ISR constellations. Tyche is managed by the UK’s Defence Intelligence Fusion Centre and designed for NATO interoperability.

U.S. Protected Tactical SATCOM

The Space Force’s PTS-G initiative is contracting commercial builders to deploy hardened, jam-resistant military satellites.^8^

Contract Diversification

New vendors like Capella, Umbra, and BlackSky are being funded to offset reliance on Maxar and Planet. Five Eyes allies are integrating multi-vendor tasking pipelines.

Legal Reform

Congress is considering legislation mandating operational continuity clauses and emergency-use controls in all national security satellite contracts.

Strategic Forecast and Policy Recommendations

Forecast

- Autonomous AI-driven ISR workflows will replace human image analysts.

- LEO CubeSats will democratize ISR further, making conflict surveillance ubiquitous.

- Adversaries will target commercial space assets with electronic warfare, malware, and legal warfare.

- Regulation will increase, forcing formal classification of combatant vs non-combatant satellite behavior.

Recommendations

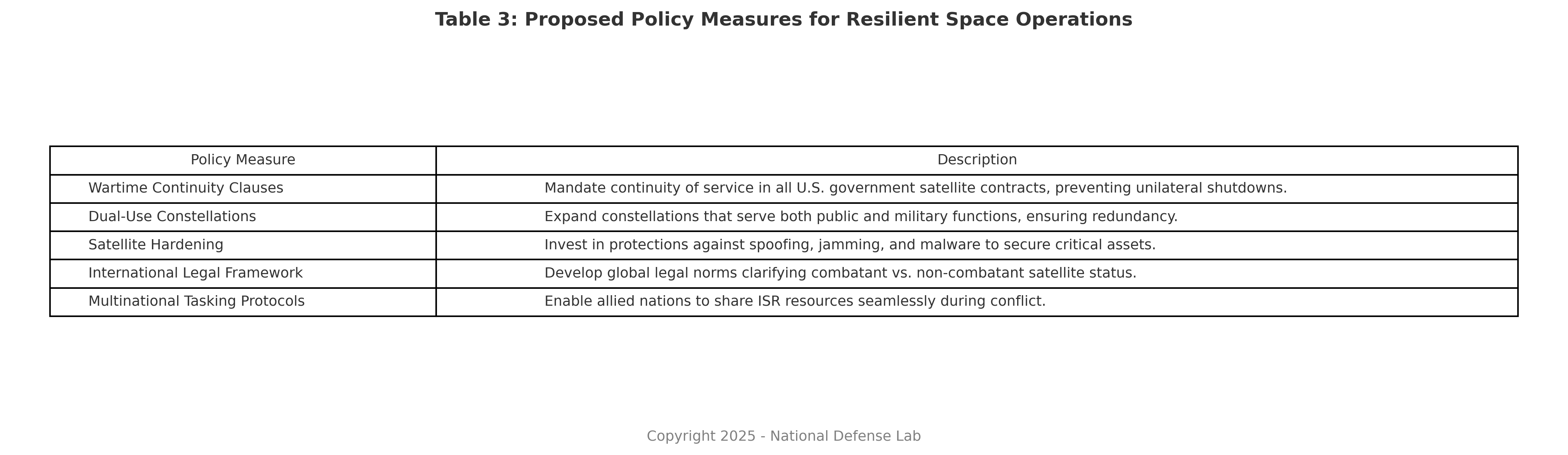

- Require all U.S. government satellite contracts to include wartime continuity clauses.

- Expand dual-use constellations that serve both public and military functions.

- Harden critical satellites against spoofing, jamming, and malware.

- Create an international legal framework defining the combatant status of commercial satellites.

- Expand multinational tasking protocols, so allied nations can share ISR resources in conflict.

Conclusion

The war in Ukraine marked the point at which commercial space assets became integral to warfare. Their use has proven invaluable, but also exposed risks, dependencies, and legal blind spots. If governments do not act now, they will face future crises with unregulated platforms, uncertain alliances, and fragmented control of the orbital domain.

Strategic space superiority is no longer just about rockets and satellites. It is about control of information, integration of platforms, and the resilience of infrastructure under pressure. The battlefield is not coming to orbit. It is already there.

Notes

- “Elon Musk’s Starlink Complicates Ukraine War Efforts,” Washington Post, March 6, 2023.

- Raphael S. Cohen, Gian Gentile, and Nathan Beauchamp-Mustafaga, Ukraine’s Military-Technical Innovation During the Russo-Ukrainian War, RAND Corporation, 2023.

- Valerie Insinna, “Ukraine’s GIS Arta Shows How to Connect Sensors and Shooters,” Air and Space Forces Magazine, June 2023.

- Ivana Kottasová, “Palantir’s AI Is Helping Ukraine in War Efforts,” CNN International, April 18, 2023.

- Ronan Farrow, “Elon Musk’s Shadow Rule,” The New Yorker, August 28, 2023.

- “Russia Warns U.S. Commercial Satellites Could Become Targets if Used in War,” Reuters, October 27, 2022.

- Secure World Foundation, Global Counterspace Capabilities: An Open Source Assessment, April 2023; Hudson Institute, Competing in the Electromagnetic Spectrum: Future of War, 2022.

- Rachel S. Cohen, “Space Force Turns to Commercial Designs for Protected Satcom,” Air and Space Forces Magazine, September 2023.